If you want to start a successful insurance agency or expand your current insurance business, you need a business plan.

The following sample insurance business plan provides the key elements to include in a successful insurance agency business plan.

[Company Name], located at [insert location here] is a new small business insurance brokerage firm finding property, casualty, and health insurance to its clients. The company will operate in a professional setting, conveniently located next to [notable bank] in the center of the shopping district. [Company Name] is headed by [Founder’s Name], an MBA Graduate from UCLA with 20 years of experience working as an insurance broker for businesses and individuals.

Services

[Company Name]will focus on close client relationships. It has a full-time assistant who, among other things, will focus on answering client’s daily questions and drafting newsletters to increase client communication.

The founder, [Founder’s Name], will also focus on answering his clientele’s needs. In addition to newsletters and email updates, [Founder’s Name] will hold webinars on insurance concerns for clients.

[Company’s Name] services include finding all types of small business insurance: health, property, casualty, renter’s, and key employee. By offering every type of insurance a small business may need, [Company Name] will become a long-term partner with each client rather than a one-time transaction.

Customer Focus

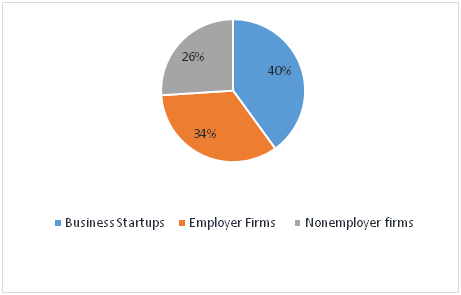

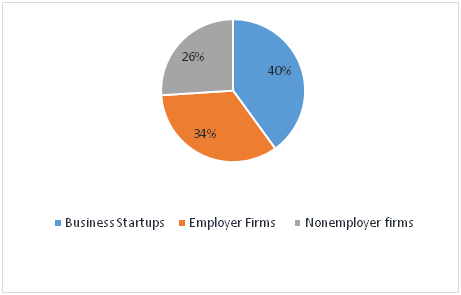

[Company Name] will primarily serve the businesses within a 20 mile radius of our location. The demographics of these customers are as follows:

These small businesses are often growing and in need of additional insurance as they grow. Furthermore, [Company Name] will seek contacts with business startups in order to find insurance for them from the time of their launch on.

Management Team

[Company Name]’s most valuable asset is the expertise and experience of its founder, [Founder’s Name]. [First name] has been a licensed insurance broker for the past 20 years. He has spent much of his career working at One-Stop Insurance Brokers, Inc. There he specialized in personal insurance for 10 years before moving to specialize in business insurance for the next 5 years.He sold business insurance to over 1,000 firms during that time.

[Company Name] will also employ an experienced assistant to help with various administrative duties around the office. [Assistant’s name] has experience working with C-level executives and has spent significant time as an administrator.

[Company Name] is uniquely qualified to succeed due to the following reasons:

[Company Name] is seeking a total funding of $160,000 of debt capital to open its office. The capital will be used for funding capital expenditures and location build-out, hiring initial employees, marketing expenses and working capital.

Specifically, these funds will be used as follows:

Topline projections over the next years are as follows:

| Financial Summary | FY 1 | FY 2 | FY 3 | FY 4 | FY 5 |

|---|---|---|---|---|---|

| Revenue | $174,038 | $592,543 | $1,821,537 | $1,822,898 | $2,655,557 |

| Total Expenses | $227,729 | $348,598 | $564,931 | $818,909 | $1,005,844 |

| EBITDA | ($53,691) | $243,945 | $1,256,607 | $1,003,989 | $1,649,712 |

| Depreciation | $7,280 | $7,280 | $7,280 | $7,280 | $7,280 |

| EBIT | ($60,971) | $236,665 | $1,249,327 | $996,709 | $1,642,432 |

| Interest | $10,309 | $9,020 | $7,732 | $6,443 | $5,155 |

| PreTax Income | ($71,280) | $227,645 | $1,241,595 | $990,265 | $1,637,278 |

| Income Tax Expense | $0 | $54,728 | $434,558 | $346,593 | $573,047 |

| Net Income | ($71,280) | $172,917 | $807,037 | $643,673 | $1,064,231 |

| Net Profit Margin | - | 29% | 44% | 35% | 40% |

| Full-time Brokers | 1 | 2 | 2 | 3 | 3 |

| Client Base | 136 | 395 | 695 | 1,019 | 1,321 |

[Company Name], located at [insert location here] is a new small business insurance brokerage firm finding property, casualty, and health insurance to its clients. The company will operate in a professional setting, conveniently located next to [notable bank] in the center of the shopping district. [Company Name] is headed by [Founder’s Name], an MBA Graduate from UCLA with 20 years of experience working as an insurance broker for businesses and individuals

While [Founder’s Name] has been in the insurance brokerage business for some time, it was in [month, year] that he decided to launch [Company Name]. Specifically, during this time, [Founder] met with a former friend and fellow independent small-business insurance broker in Fort Lauderdale, FL who has had tremendous success. After discussing the business at length, [Founder’s Name] clearly understood that a similar business would enjoy significant success in his hometown.

Specifically, the customer demographics and competitive situations in the Fort Lauderdale location and in his hometown were so similar that he knew the business would work. After surveying the local population, [Founder’s name] went ahead and founded [Company Name].

Upon returning from Fort Lauderdale, surveying the local customer base, and finding a potential retail office, [Founder’s Name] incorporated [Company Name] as an S-Corporation on [date of incorporation].

The business is currently being run out of [Founder’s Name] home office, but once the lease on [Company Name]’s office location is finalized, all operations will be run from there.

Since incorporation, the Company has achieved the following milestones:

[Founder’s Name] will be able to provide clients with the following services:

As [Founder’s Name] understands, the key to a successful brokerage business is being accessible and staying in contact with clients. [Founder’s Name] will have a full-time assistant on hand who, among other things, will manage client’s phone calls and answer questions as possible.

Last year, according to IBISworld.com, U.S. insurance brokerage and agencies brought in revenues of $117 billion and employed 965,000 people. There were 381,116 businesses in this market, for an average of $308,000 per business. The average wage paid to an insurance industry employee was $55,736.

Overall, the insurance sector has fundamentally changed. The old practice of incurring underwriting losses, offset by large investment gains, is a thing of the past. As underwriting performances have improved, risk has been priced appropriately. This has triggered soft market conditions, revenue volatility is expected to remain low and the state of primary insurance markets will continue to have a strong bearing on industry prospects.

Key players in the industry include Marsh and McLennan Companies, Inc, Aon Corporation, and Willis Group Holdings LimitedWhile there are major players, most of the industry consists of small, independent insurance brokers and firms. Large firms often pay significant amounts for an independent broker to join them and bring their client base along.

The following are industry trends identified:

[Company Name] will serve small businesses in [company location] and the immediately surrounding area.

The area we serve is suburban, with retail stores as a primary business sector. In addition, some light manufacturing companies have their facilities in the area.

The precise demographics of the town in which our location resides is as follows:

| Nashville, TN | |

|---|---|

| Total Population | 611,577 |

| Total Businesses | 38,124 |

| Forestry, Fishing, Hunting, and Agriculture Support | 0.29% |

| Mining | 0.35% |

| Utilities | 0.23% |

| Construction | 9.64% |

| Manufacturing | 4.16% |

| Wholesale Trade | 5.62% |

| Retail Trade | 14.54% |

| Transportation and Warehousing | 2.83% |

| Information | 1.81% |

| Finance and Insurance | 6.56% |

| Real Estate and Rental and Leasing | 4.75% |

| Professional, Scientific and Technical Services | 11.36% |

| Management of Companies and Enterprises | 0.69% |

| Admin, Support, Waste Mgt, Remediation Services | 5.15% |

| Educational Services | 1.20% |

| Health Cate and Social Assistance | 10.80% |

| Arts, Entertainment and Recreation | 1.66% |

| Accommodation and Food Services | 8.59% |

| Other Services (Except Public Administration) | 9.78% |

The Company will primarily target the following three customer segments:

The following small business insurance broker age firms are located within a 20 mile radius of [Company Name], thus providing either direct or indirect competition for customers:

Small Biz Insurance

Small Biz Insurance is an owner-operated business run by Bob Johnson. Having started the business ten years ago, Johnson operates out of his home to keep down costs and meets with small businesses in the surrounding area at their offices. Johnson focuses primarily on casualty insurance and does not deal with health insurance providers. .

Small Biz Insurance has an estimated $300,000 in annual revenue and serves a small subset of area clients. However, its name and focus on small business insurance bring it to the top of local search rankings, causing many small businesses to consider working with Johnson.

Marsh Inc.

Marsh Inc. is part of Marsh & McLennan companies, a vast insurance and consulting company with 57,000 employees and revenue of $12 billion. Marsh itself employs approximately 40,000 people with $6.9 billion annual revenues. Its nearest office location is in [city name].

Unlike [Company Name], whose revenues will come entirely from commissions from insurance companies, Marsh receives advisory fees for locating property and casualty insurance for its clients who are mainly large companies, but include some small companies. This arrangement helps to maintain the company’s reputation as an impartial advisor, but generally makes insurance more expensive for their clients.

Small business clients go to Marsh because of its wide presence on the Internet, public brand awareness, and track record. However, many startups and small businesses cannot afford the fees of working with Marsh and instead seek insurance directly from insurance providers.

One-Stop Insurance Brokers

One-Stop is a local firm with 100 active brokers serving the [company location] area. One-Stop has approximately 70 brokers selling business insurance and 30 selling personal insurance. Local small businesses have increasingly used One-Stop brokers for their small business needs over the past ten years. [Founder’s Name] was one of the lead salespeople at One-Stop while he worked there.

One-Stop attempts to offer all types of insurance to business clients, going beyond the needs of small businesses. Some small businesses have expressed that they do not receive adequate customer service from their One-Stop brokers due to the larger clients that these brokers are also trying to serve. Furthermore, One-Stop does not provide intellectual property through newsletters, online content, or seminars, specifically aimed at small business audiences.

[Company Name] enjoys several advantages over its competitors. These advantages include:

[Company name] will use several strategies to promote its name and develop its brand. By using an integrated marketing strategy, [company name] will win clients and develop consistent revenue streams.

The [Company name] brand will focus on the Company’s unique value proposition:

Targeted Cold Calls

[Company name] will initially invest significant time and energy into contacting potential clients via telephone. In order to improve the effectiveness of this phase of the marketing strategy, a highly-focused call list will be used, targeting startups and small businesses. As this is a very time-consuming process, it will primarily be used during the startup phase to build an initial client base.

Referrals

[Company name] understands that the best promotion comes from satisfied customers. The Company will encourage its clients to refer other businesses by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Additionally, [company name] will aggressively network with business incubators, small business development centers, small business accountants, lawyers working with startups and small businesses, and others in a position to advise small businesses and startups. This network will generate referral leads.

Internet

[Company name] will invest resources in two forms of geographically-focused internet promotion—organic search engine optimization and pay-per-click advertising. The Company will develop its website in such a manner as to direct as much traffic from search engines as possible. Additionally, it will use highly-focused, specific keywords to draw traffic to its website, where potential clients will find a content-rich site that presents [Company name] as the trustworthy, well-qualified insurance brokerage firm that it is.

Publications

[Company name] will place print advertisements in key local publications, including newspapers, area magazines, and business newsletters. Additionally, the Company will print brochures and place them in specific locations frequented by target individuals, such as small business development centers and accountants.

[Company Name]’s pricing will rely on a 10% average commission from insurance companies on premiums sold to clients. The price to clients will be nothing, making the service less expensive than firms like Marsh which charge advisory fees to clients. By seeking quality clients and maintaining long-term relationships with them, [Company Name] will maintain a high average commission rate and earn bonus commissions from insurance companies by providing long-term profitable clients.

[Company Name] will carry out its day-to-day operations primarily on an appointment basis. Clients will make appointments to review their insurance and to discuss renewals. These will primarily occur in-office or on-site at the client’s business in order to increase the strength of the client relationship. If necessary, appointments can be conducted over the telephone.

[Founder’s Name] will work on an as-needed basis, but can be expected to be present in the office during normal business hours. The company will also employ an administrative assistant who will also support marketing and client relationship development efforts.

Company name]’s long term goal is to become the number-one provider of small business insurance services in the [city] area in terms of customer service quality. We seek to do this by ensuring customer satisfaction and developing a loyal and successful clientele.

The following are a series of steps that will lead to this long-term success. [Company Name] expects to achieve the following milestones in the following [xyz] months:

| Date | Milestone |

|---|---|

| [Date 1] | Finalize lease agreement |

| [Date 2] | Design and build out [Company Name] storefront |

| [Date 3] | Hire and train initial staff |

| [Date 4] | Kickoff of promotional campaign |

| [Date 5] | Reach break-even |

| [Date 6] | Reach XXX ongoing clients |

[Company Name]’s most valuable asset is the expertise and experience of its founder, [Founder’s Name]. [First name] has been a licensedinsurance broker for the past 20 years. He has spent much of his career working at One-Stop Insurance Brokers, Inc. There he specialized in personal insurance for 10 years before moving to specialize in business insurance for the next 5 years.He sold business insurance to over 1,000 firms during that time, brining in revenue of $2 million.

[Founder’s Name] maintains his license in the state of [state] and the states of [other states]. His additional certifications include the CLU (Certified Life Underwriter) designation and the CFP (Certified Financial Planner) designation. [First name] has spoken at regional conferences and taken part in small business and startup panel discussions at the local library, Chamber of Commerce, and small business development center.

[Company Name] will also employ an experienced assistant to help with various administrative duties around the office. [Assistant’s name] has experience working with C-level executives and has spent significant time as an administrator.

[Founder’s Name] will serve as the company CEO and president. In order to launch the business we do not need additional personnel, but will hire the following in the future:

[Company Name]’s revenues will come primarily from the commissions earned from insurance providers on premiums paid by clients. Secondly, revenue will come from bonus commissions from those insurance companies.

[Company Name] will seek an average 10% commission from all insurance providers it works with. New clients will be added consistently each quarter, and most will remain clients as we expect a quarterly client attrition rate of only 2%. We also expect a $1,000 bonus commission to be paid on roughly 5% of clients.

As with most services, labor expenses are the key cost drivers. [Founder’s Name] and future brokers will earn a competitive base salary. The lease on the office location will be the next largest cost. Furthermore, the costs of transactionsare projected to be roughly 20% of regular commission revenue.

Moreover, ongoing marketing expenditures are also notable cost drivers for [Company Name].

[Company Name] is seeking a total funding of $160,000 of debt capital to open its office. The capital will be used for funding capital expenditures and location build-out, hiring initial employees, marketing expenses and working capital.

Specifically, these funds will be used as follows:

The following table reflects the key revenue and cost assumptions made in the financial model.

| Number of clients | |

|---|---|

| Year 1 | 136 |

| Year 2 | 395 |

| Year 3 | 695 |

| Year 4 | 1019 |

| Year 5 | 1321 |

| Bonus Commissions | $1,000 |

| Premium Commissions | $7,500 |

| Annual rent | $36,000 |

5 Year Annual Income Statement

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Revenues | |||||

| Product/Service A | $151,200 | $333,396 | $367,569 | $405,245 | $446,783 |

| Product/Service B | $100,800 | $222,264 | $245,046 | $270,163 | $297,855 |

| Total Revenues | $252,000 | $555,660 | $612,615 | $675,408 | $744,638 |

| Expenses & Costs | |||||

| Cost of goods sold | $57,960 | $122,245 | $122,523 | $128,328 | $134,035 |

| Lease | $60,000 | $61,500 | $63,038 | $64,613 | $66,229 |

| Marketing | $20,000 | $25,000 | $25,000 | $25,000 | $25,000 |

| Salaries | $133,890 | $204,030 | $224,943 | $236,190 | $248,000 |

| Other Expenses | $3,500 | $4,000 | $4,500 | $5,000 | $5,500 |

| Total Expenses & Costs | $271,850 | $412,775 | $435,504 | $454,131 | $473,263 |

| EBITDA | ($19,850) | $142,885 | $177,112 | $221,277 | $271,374 |

| Depreciation | $36,960 | $36,960 | $36,960 | $36,960 | $36,960 |

| EBIT | ($56,810) | $105,925 | $140,152 | $184,317 | $234,414 |

| Interest | $23,621 | $20,668 | $17,716 | $14,763 | $11,810 |

| PRETAX INCOME | ($80,431) | $85,257 | $122,436 | $169,554 | $222,604 |

| Net Operating Loss | ($80,431) | ($80,431) | $0 | $0 | $0 |

| Income Tax Expense | $0 | $1,689 | $42,853 | $59,344 | $77,911 |

| NET INCOME | ($80,431) | $83,568 | $79,583 | $110,210 | $144,693 |

| Net Profit Margin (%) | - | 15.00% | 13.00% | 16.30% | 19.40% |

5 Year Annual Balance Sheet

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| ASSETS | |||||

| Cash | $16,710 | $90,188 | $158,957 | $258,570 | $392,389 |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 |

| Inventory | $21,000 | $23,153 | $25,526 | $28,142 | $31,027 |

| Total Current Assets | $37,710 | $113,340 | $184,482 | $286,712 | $423,416 |

| Fixed assets | $246,450 | $246,450 | $246,450 | $246,450 | $246,450 |

| Depreciation | $36,960 | $73,920 | $110,880 | $147,840 | $184,800 |

| Net fixed assets | $209,490 | $172,530 | $135,570 | $98,610 | $61,650 |

| TOTAL ASSETS | $247,200 | $285,870 | $320,052 | $385,322 | $485,066 |

| LIABILITIES & EQUITY | |||||

| Debt | $317,971 | $272,546 | $227,122 | $181,698 | $136,273 |

| Accounts payable | $9,660 | $10,187 | $10,210 | $10,694 | $11,170 |

| Total Liabilities | $327,631 | $282,733 | $237,332 | $192,391 | $147,443 |

| Share Capital | $0 | $0 | $0 | $0 | $0 |

| Retained earnings | ($80,431) | $3,137 | $82,720 | $192,930 | $337,623 |

| Total Equity | ($80,431) | $3,137 | $82,720 | $192,930 | $337,623 |

| TOTAL LIABILITIES & EQUITY | $247,200 | $285,870 | $320,052 | $385,322 | $485,066 |

5 Year Annual Cash Flow Statement

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | |||||

| Net Income (Loss) | ($80,431) | $83,568 | $79,583 | $110,210 | $144,693 |

| Change in working capital | ($11,340) | ($1,625) | ($2,350) | ($2,133) | ($2,409) |

| Depreciation | $36,960 | $36,960 | $36,960 | $36,960 | $36,960 |

| Net Cash Flow from Operations | ($54,811) | $118,902 | $114,193 | $145,037 | $179,244 |

| CASH FLOW FROM INVESTMENTS | |||||

| Investment | ($246,450) | $0 | $0 | $0 | $0 |

| Net Cash Flow from Investments | ($246,450) | $0 | $0 | $0 | $0 |

| CASH FLOW FROM FINANCING | |||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 |

| Cash from debt | $317,971 | ($45,424) | ($45,424) | ($45,424) | ($45,424) |

| Net Cash Flow from Financing | $317,971 | ($45,424) | ($45,424) | ($45,424) | ($45,424) |

| SUMMARY | |||||

| Net Cash Flow | $16,710 | $73,478 | $68,769 | $99,613 | $133,819 |

| Cash at Beginning of Period | $0 | $16,710 | $90,188 | $158,957 | $258,570 |

| Cash at End of Period | $16,710 | $90,188 | $158,957 | $258,570 | $392,389 |